Let’s start by discussing how to be wealthy under 40.

1. Here is how you can start working towards it.

2. Start saving early.

3. Setting financial goals.

4. Avoid unnecessary spending and debt.

5. Increase your income money.

6. Save 15% or more of every paycheque.

7. Live below your means.

8. Don’t Give in to Lifestyle Inflation.

9. Invest wisely.

10. Continuously educate yourself.

11. Be patient and persistent.

12. Get Help If You Need It.

Here is how you can start working towards it.

Becoming a millionaire before the age of 40 is an achievable financial goal if you set your mind to how to be wealthy under 40. However, it does require a combination of smart financial planning, disciplined saving and investing, and entrepreneurial spirit. Here are some things that you must start with to make this goal achievable.

Start Saving Early

To begin your journey of becoming a millionaire, start saving early in life. Building your savings gradually allows you to take advantage of the incredible power of compounding over the years. Compounding means you earn interest on your interest by reinvesting your interest or capital gains.

If you’re 20 years old and want to how to be wealthy under 40 then If you contribute 72,000 to an individual retirement fund every year (6000 a month) for 40 years, your total investment would be 14,40000 lakh.

However, with the power of compounding interest, your nest egg would be worth much more. Assuming a 12% return, with yearly compounding, it would total 55,19144. And do not invest and withdraw next 10 years. You would be a millionaire 1,71,41614 by age 50 just by saving 6000 a month. You’d rather be a millionaire by age 30. If that’s your goal, try to put more money away each month. Follow the other steps below.

Create a savings plan, which reviews your monthly debts, income, and financial goals.

Next, automate your savings by setting up a direct deposit for a small 6000 amount from your paycheck to a savings account monthly. If you don’t see the money in your checking account, you’re less likely to spend it.

Setting financial goals

To become a millionaire before 40, you need to start with a clear financial plan. Define your goal, and how much money you want to have saved or invested by the age of 40. Create a timeline. This goal will motivate you to stay on track.

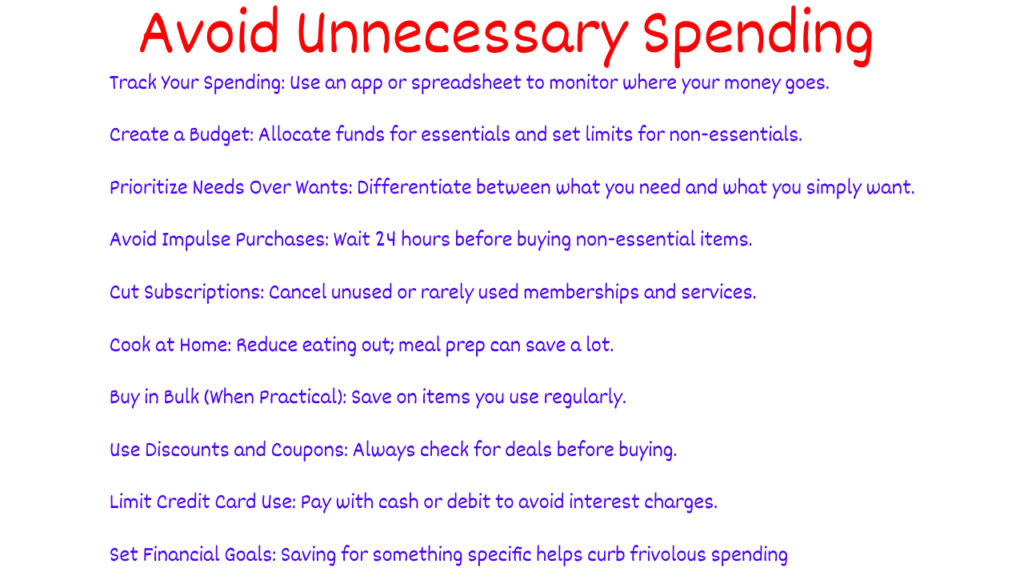

Avoid Unnecessary Spending and Debt

Stop buying things you don’t need, especially if you use a high-interest credit card for the purchases. Before buying anything, ask yourself the following:

- Is this something I really need?

- Am I spending money simply for entertainment or trying to impress others?

- Do I have something similar already?

- Do I want this more than I want to become a millionaire?

Every rupee you spend on something you don’t need is one less rupee that can make money for you.

Here’s a reality check: If, instead of spending an extra 1,000 a week, you save and invest it for 20 years, you will end up with 36,79429 with the 12% annual return and compounding). Can you cut 1000 of unnecessary spending out of your weekly budget. If you can, that effort alone will go a long way toward helping you reach your goal of becoming a millionaire.

Increase your income

When considering how to be wealthy under 40, remember that financial literacy is key. Understanding investments and savings is crucial to achieving this goal.

One of the most straightforward ways to accumulate wealth is to increase your earning potential. Look for opportunities to advance in your career. Work on acquiring new skills, and consider side hustles. Diversifying your income sources can significantly boost your earnings.

Making more money is easier said than done, but if you don’t earn enough to save 15% of your income, it will be challenging to become a millionaire.

Learning how to be wealthy under 40 can begin with simple budgeting techniques that track your spending and savings.

By understanding how to be wealthy under 40, you improve your financial decisions and create a better future.

Setting financial goals will clarify how to be wealthy under 40 and help you stay focused on your progress.

Automating your savings can be an effective strategy for how to be wealthy under 40, ensuring you consistently set money aside.

You do have a few options available to you, including:

Make sure your financial plan outlines how to be wealthy under 40, including potential income sources and investment opportunities.

- Ask for a pay increase (if you think you’re due for one)

- Work extra hours

- Get a second job

- Get training to increase your earnings potential

- Switch career paths

Consider how to be wealthy under 40 by evaluating your current expenses and prioritizing needs versus wants.

Additional training pays off the most in the long run on the other hand, earn about 4lakh+ in a year. It takes one to three years of additional education to qualify to be an expert. However, the extra money you’d take home every year can help you reach your financial goals and, eventually, become a millionaire.

Save 15% of Your Income—or More

The personal savings rate is the percentage of income left over after people spend money and pay taxes According to experts, that’s not enough for a comfortable retirement let alone for anyone aiming to become a millionaire.

Exactly how much should you save? Although there’s no correct answer, most financial planners say that, depending on your age, you should save at least 15% of your annual gross income for your retirement. That figure is ambitious but not necessarily unattainable. For example, if your employer matches contributions of up to 15% of your salary in your 40s plan.

Live below your means

Understanding the impact of spending on your savings will guide you in how to be wealthy under 40.

If you want to save then you have to live below your means. You have to keep your expenses in check and avoid excessive spending on items you do not really need. The more you can save from your income, the more you can invest and grow your wealth.

Increasing your income is critical to how to be wealthy under 40; explore various avenues for additional revenue streams.

Don’t Give in to Lifestyle Inflation

When considering how to be wealthy under 40, remember to assess your career trajectory and seek advancement opportunities.

Lifestyle inflation is a common consequence of career advancement. You spend more money just because you have more money to spend.

You may decide your apartment is too small and need a house in the suburbs. You realize that you can come up with a down payment for a much fancier car. Your vacation plans get more ambitious and expensive.

If you want to become a millionaire, resist the urge to give in to lifestyle inflation. Instead of spending more-just because you can-save and invest more. Imagine the pleasure of watching your financial account balances grow. And you’ll reach your financial milestones faster.

Invest wisely

Investing is important for wealth accumulation. Consider a diversified investment strategy that includes stocks, bonds, real estate, and other assets. Start early and stay committed to a long-term investment strategy, taking advantage of compound interest to grow your wealth over time. Consult with a financial advisor or planner to make informed investment decisions.

Continuously educate yourself

We all know and need to accept that the financial world is ever evolving. To make smart investment decisions, you need to stay informed. Read up on them, take courses, and keep up with financial news. Learning about different investment opportunities and strategies will help you make informed choices, reducing your financial risks and maximizing your returns.

Be patient and persistent

To become a millionaire before 40, it is bound to take you years of hard work and perseverance. Stay patient and persistent, and don’t be discouraged by setbacks or temporary financial challenges.

Get Help If You Need It

Planning for retirement can be stressful. That’s because you know you’ll need a substantial amount of money when you no longer work, all of the investment options available and the knowledge and experience it takes to invest successfully. In one survey, only 12% of Indians said they’re very confident that they will be able to retire comfortably.

Unless you’re a financial rock star or someone willing and able to make an effort to research investment opportunities, it’s worth the money to work with a qualified financial advisor to come up with a personalized and workable retirement plan.

Living below your means is essential in learning how to be wealthy under 40, as it maximizes your savings potential. An advisor can help you choose investments, create a budget, and make plans to reach your goals. And once you’re ready to spend some of that money.

Resist the desire to spend more as you make more money. Investment strategies should include a focus on how to be wealthy under 40, emphasizing risk management and diversification.

Continuous education on financial matters is vital for anyone interested in how to be wealthy under 40. Patience is a virtue in learning how to be wealthy under 40; long-term planning will yield the best results. If you struggle with how to be wealthy under 40, seeking help from a financial expert may provide the clarity you need. Learning how to be wealthy under 40 also involves recognizing the importance of budgeting and financial planning. for reading others click here!

Finally, remember that your journey on how to be wealthy under 40 begins with making informed financial decisions today. you can also check here